Mission accomplished

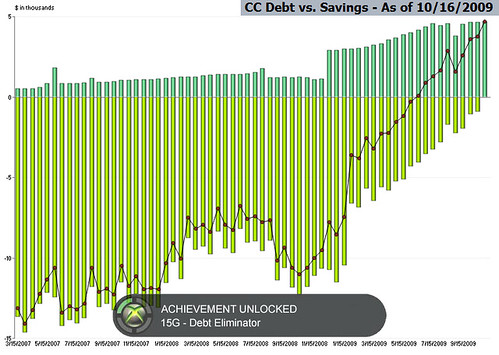

In 2000, I got my first credit card, a Capital One card with a $300 limit. Ever since then I have been in credit card debt. 2½ years ago, I was $15,000 in credit card debt and had virtually no savings. 1 year ago, I wasn’t doing much better. This year, for a new years resolution, I vowed to get out of credit card debt.

Today, I made a final $914.34 payment, and with that, I have eliminated nearly a decade of credit card debt.

I did it.

Even better, in the process I have managed to grow my savings from almost nothing to nearly $5,000. And now that I have no credit card debt, I can grow that savings even faster.

Even better, in the process I have managed to grow my savings from almost nothing to nearly $5,000. And now that I have no credit card debt, I can grow that savings even faster.

How did I do it? There is a wealth of information available available on the web for getting out of debt. Here’s a few of the methods I used to help with my goals.

- Figure out where you are now. I had been using Quicken off and on for years. The problem would be when I wouldn’t update it for a few days. Days would turn into weeks, weeks into months, and before long I just wouldn’t know where I was at financially. At that point I would pretty much stick my head in the sand. Because I didn’t know how much money I had on hand, I would start putting various purchases on a credit card. It was a nasty cycle.

Like an alcoholic needs to admit he has a problem before he can turn his life around, a debtor needs to know how badly he is in debt before he can reverse this debt.

-

Track everything. Get Quicken, or some other financial software. Enter all of your accounts, and enter as much history as you can. Get as many accounts set up for online download as you can. Enter daily expenses daily. Set up recurring payment reminders. All of them. Even the ones you may be embarrassed to yourself about. You can (and will) start changing your spending habits later. The important thing right now is to know where you are now. If you miss a couple days, do not give up.

-

Make goals that fit your current situation. Now that you know where you are, you can start to do something about it. Even if you can only pay $50 toward your debt, you’ll at least know you’re putting $50 toward your debt. Figure out how long it will take to pay off your debt at that rate. In my case, I was already putting $720 per month toward credit card debt. (The meaning of that number is long since lost, but at least it’s a number). That sounds like a lot (and is!), but because I had such bad financial practices, a lot of that was going right back on the cards in the form of new debt. I wouldn’t actually recommend making a budget at this point, just make goals and tailor each action you make toward those goals.

-

Do not give up. Yes, I’ve said it twice already, but it really needs to be reinforced. Do not fear your finances. Do not stick you head in the sand. Be obsessive. It seems one of my hobbies these days is playing with various reports in Quicken, and that “hobby” has really helped me toward my goal.

-

Build up savings. You’re not going to like hearing this, but you’ll need an emergency fund on top of paying off debt. In fact, it’s better to have debt and savings than no debt but no savings, especially in these times. How much really depends on your situation. Make sure a minimum fixed portion of your income goes to savings. Any savings you find beyond that is simply a bonus.

Also remember, a lot of these tips will actually deal more with savings and less with reducing debt, but most of them can be suited for either. Do you take that $20 per month you saved from lowering your insurance payment and apply it to reducing debt, or increasing savings? It will really depend on your individual situation.

- Make your savings less accessible. A big problem with holding on to savings was my primary savings account was at the same bank as my checking account. Whenever I would slip into a situation where I did not know the status of my finances, I would do two things: start using credit cards, and dip into savings. The temptation is far too great when the word “savings” is right next to the word “checking” on that ATM menu.

Today, there are plenty of Internet banks to put your money in. Many include no fees, and nearly all charge nothing to get your money to them. I recommend [Ally Bank](http://www.ally.com/) and [Capital One Bank](http://www.capitalone.com/) through experience, and [ING Direct](http://home.ingdirect.com/) through reputation. They offer accounts with no fees, allow for automated pull transfers from my (Wells Fargo) checking account, and offer decent interest rates. Capital One offers an ATM card as part of its money market savings account, but I did not accept it. See, when it takes 3 days to transfer funds back from these banks to your checking account, you are much less likely to even consider it.

I still keep a couple hundred dollars in my Wells Fargo savings account for potential short term emergencies. It's just enough to cover things for a few days in case I needed to transfer funds from Ally or Capital One for larger emergencies. And of course since I now know the status of my finances at all times, I don't dip into those short term emergency funds.

Also, keep in mind that [Regulation D](https://www.ufcu.org/tools/help/reg_d_faq.php) places a limit of six withdrawals per month on online transfers, so be careful when transferring from a savings account to a savings account. Checking to savings is unlimited, which is why I prefer having my entire paycheck direct deposited into my checking account, then using automated transfers to go to their final destinations.

-

Build a safety net into your checking account. I went into this in more detail in a previous blog post, but reduce the perceived balance of your checking account by a few hundred dollars. This will make it less likely that you will need to dig into savings, go to a credit card, or, worst of worst, go to a payday loan place due to irregularities from month to month. Once you do this, tell your bank to cancel overdraft protection on your account if they offer an opt-out, as this service can often do more harm than good.

-

Reduce expenses. Cancel your cable and apply it to your debt/savings. Cancel that MMO you never play any more. Stop going to Starbucks. There is usually plenty of low-hanging fruit to pick from. Each time you receive a lump sum (say, a gift or a rebate), deposit it in savings. When you save recurring monthly costs through reducing expenses, set up automatic transfers to your savings. Most brick-and-mortar banks allow an unlimited number of transfers out of checking, and most Internet banks allow an unlimited number of transfers into savings, so it works well.

In my case, I have a monthly $40 "Savings (Rent)" transfer from the money I saved when I re-signed my apartment lease, a bi-monthly $22 "Savings (Stim)" from the stimulus tax cut earlier this year, and so on. The trick is to have the transfers begin the same day your paycheck is deposited, so you never consider spending that money.

-

Increase income. If you are a waged employee and can work extra hours, do so. Ask for a raise. Take a second job or leave for a job with a higher salary. Do some side work. Of course, the current economy makes many of these things difficult, but remember, this isn’t a list of instructions, just possible avenues you can explore. And remember, maintain a balance in life. Don’t work 80 hours per week if it’ll make you miserable, even if it will pay your debt off faster.

-

Adjust your federal tax withholdings. For the longest time, I was claiming 0 on my W-4, and I imagine many people are the same, claiming 0 or 1. Essentially, I was having a large extra amount taken out of each paycheck, and was getting it back in one lump sum in April. If, like me, you are a single taxpayer without much complication in your tax setup (standard deduction, etc), you can switch your withholding from 0 to 2. You will get back more with each paycheck, and will only owe or get back less than $20 come April 15.

Now, it should come as no surprise that my next suggestion is to figure out how much extra you are getting back per paycheck, and set up an automatic transfer of that money into your savings. Remember, with a higher withholding (lower number), you are giving an interest-free loan to Uncle Sam. If you decrease your withholding (increased number) and faithfully transfer that to savings, you can start earning interest on it. Today's interest rates may be lousy, but 1.5% is still better than what you were earning before.

- Sweep your savings. So now you should have a primary savings account with a small immediate emergency fund, and an Internet bank with more of your savings. Your local account, sadly, most likely has a horribly low interest rate. (As of this writing, my Wells Fargo savings account earns 0.06% APY. Sigh.) But you are regularly depositing savings into it. At this point, you should start sweeping it into the less accessible and higher-earning Internet bank account when you hit a certain balance.

Personally, I always want to have at least $300 in my primary savings account, but when it hits $500, I sweep the difference into an Internet bank. Again, remember that Regulation D limits this to six online withdrawals per month, so I would only check up on this monthly.

-

Sell some stuff. Go around the house and look for things you don’t need. Put them on Craigslist. Make some extra cash. Again, don’t sell off your happiness, but do re-evaluate what does make you happy.

-

Don’t buy new stuff. It’s as simple as that. You see that new TV over there? That 40” LCD? Don’t buy that. Many people have expensive hobbies, myself included, and while everybody likes to be entertained, it is important to curb impulses.

-

Consolidate your debt. Go to your bank and ask about a secured or unsecured loan. This is the best option for consolidating your debt. If your car is paid off, that can be used as base collateral, but you may even be able to get an unsecured consolidation loan if you have good credit.

If this does not work, think about balance transfers between cards, but be VERY careful. Many balance transfers include up-front fees and promotional rates. A 0% APR for 1 year is useless if you cannot guarantee yourself that you will pay it off in that time. The reason is that if you go 1 year + 1 day without paying it off, the card company will often backdate interest for the entire amount, at a high rate. $0 in interest could turn into $500 in interest quite literally overnight. But if, for example, you could get a 5.99% APR transfer for the lifetime of the balance with, say, a 1% transfer fee, I would consider that good enough to transfer all balances into one account. There is a science to this, <strike>but unfortunately I have yet to find a good balance transfer calculator that can take multiple cards with multiple existing APRs and convert them into a single balance with a single APR and a transfer fee, and compare that to simply not transferring balances.</strike> **EDIT** (January 2011): I finally sat down and wrote [a tool to do exactly this](https://www.finnie.org/projects/credit-card-consolidation/).

So a lot of this will be gut instinct, unless you sit down and do a lot of math. If you do consolidate debt into a single credit card, it is important that you NEVER use it for purchases after that point. Credit card companies will apply payments to your lowest interest balances first, and even a single purchase on that card can accrue astronomical interest because it won't be paid off until the end.

-

Stop using your credit cards. I hate to admit, but this is one point where I did not follow my own advice. I had all of my credit card debt on one card, but I also used another card for online purchases and recurring payments like my cellphone bill. This card, an American Express “Clear” card, earns 1% cash back (in the form of a gift card), but I made sure that I paid off the balance monthly. Multiple times per month, usually. That is the important distinction: I never actually added new credit card debt this year, though I did continue using a card. However, this requires huge discipline, which some people cannot handle. But it all comes back to keeping your finances organized. Once you know exactly where your finances are, that discipline comes easy.

-

Cancel your credit cards. This is a tricky one. If you have 20 credit cards and can consolidate them, by all means, do so and cancel many of them. Cancel all that you can if you cannot avoid the temptation of new credit card debt. If you can’t consolidate, pay off one at a time, and cancel each one after it is paid off. Of course, your credit score will take a dip because of this, but you’ll be better off in the long run. I would recommend holding on to your first credit card, if that is your oldest source of credit, though. The reason is if you cancel that, your credit score will take a massive dive. Length of credit history is one of the major factors in determining your credit worthiness.

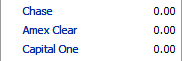

Personally, I had four major credit cards. I cancelled one, leaving me with the Amex for rewards (that, again, is used and paid off monthly), a Chase card (that had the debt), and a Capital One card, which was my first piece of credit history. I occasionally put purchases on it and immediately paid them off (most often because some places don't take Amex) to keep the account from going into disuse.

- Monitor your credit report. While technically not required to pay off debt, you still should always be aware of what is on your credit reports. Go to annualcreditreport.com, which lets you get a free yearly credit report from each of the three credit agencies. The only gotcha here is they will try to upsell you, but the credit reports themselves are free. In addition, I’d recommend Equifax, which has a range of credit subscription services, and usually has sales (for example, buy 3 get 1 free credit reports + score, which is good for checking quarterly).

I also recommend [Credit Karma](http://www.creditkarma.com/). It's a free service that lets you pull your score that they calculate based on your credit report, as often as you like. The upside is it's free, but the downside is you just get a score; you can't actually see the credit report they pull. Still, it's useful data.

- Read, constantly. There are a lot of good personal finance sites out there. My favorites are Get Rich Slowly and Consumerism Commentary. Both feature an amazing amount of personal finance tips and information.

One thing I will recommend you not do is buy personal finance books. I've read a few, and I'm not a fan. It seems like they all take a few core concepts (most of which I've already introduced here) and spread them out to fill a minimum page count. Those two sites I mentioned above have given me more information than I have through finance books.

If you still would rather go the book route, I would recommend your local library, not your local bookstore.

- And above all else, don’t listen to a word I say. Or more accurately, don’t treat my words as golden. There are many, many views on finance out there, and almost all of them conflict with each other. Some would call me crazy for not advocating starting out with a budget, for example. These tips worked for me, and I hope they work for you, but you must weigh the options and figure out your best plan for eliminating debt.

Be wary of anybody who has a "system" for getting out of debt. I read a book that, presumably with a straight face, said, "This book is all you need. Follow it and you will get out of debt." I immediately put down the book. I'm sure it had some useful information, but that passage was the equivalent of a used car salesman. The only sure fire solution to debt is education. Learn as much as you can from as many sources as you can.

- One more thing… Celebrate! When you reach your goal, throw a party. Tell everyone you know. Make a copy of your final check and frame it. This is definitely one of the best days of my life. I had been in credit card debt for nearly a decade, and this is a massive weight off my shoulders. The best part was opening Quicken this morning and seeing “$0.00” next to each credit card balance, where there used to be red numbers.

Note that I kept saying “credit card debt”. I still have a $16,000 car loan, but now that I am out of credit card debt, I have a lot more options open to pay off that loan. The original plan, after eliminating credit card debt, was to split the former $720 payment. $360 would go to savings, and $360 to extra principal on the car loan. I’m starting to question that distribution (I’m thinking of leaning more toward savings), but I’ve got a month to figure out a plan before it goes into effect.

(NB: This just happened to be my 800th blog post. Wow. It started out with a paragraph and a 5-point bullet list, but has expanded to a 3000-word essay. Maybe I should write a book.)